Affiliate Disclosure: Automoblog and its partners may earn a commission when you use the services and tools here for extended warranties and auto loan comparisons. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of extended warranty and auto loan providers. See our Privacy Policy to learn more.

MSRP vs. Invoice Price

Knowing the difference between the MSRP and the invoice price may help you save money on a new vehicle. The quick explanation is that MSRP is for consumers, and the invoice price is for dealers. In this guide, we will go through both and share some best practices that may help you ultimately pay less money for a new vehicle.

To help visualize this MSRP vs. invoice price concept, think in terms of higher and lower and easy and not so easy. This is important because it impacts a dealer’s profit margin and the final cost of a new car. Let’s start by quickly defining each.

What Is MSRP?

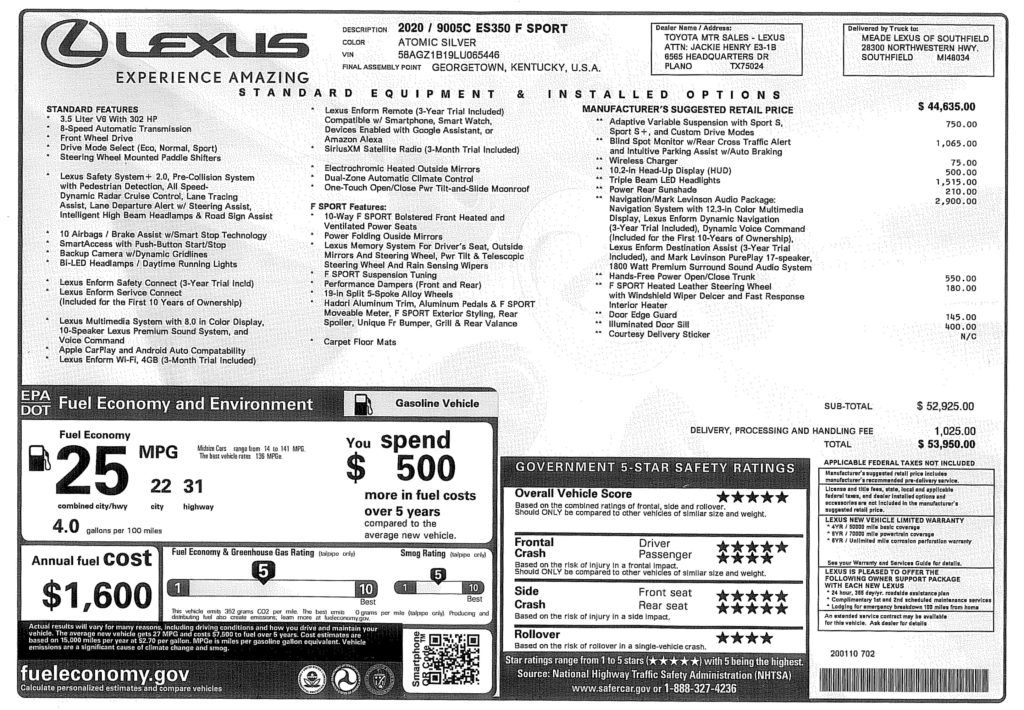

MSRP is the acronym for Manufacturer’s Suggested Retail Price. Sometimes referred to as the “retail price” or “sticker price,” the MSRP is the purchase price as suggested by the automaker. The MSRP is easy to find. It will be readily available on the vehicle’s window sticker (maybe even boxed and highlighted), on a dealer’s website, or listed in almost every car review.

Despite being easy to find, the sticker price is one of the higher figures you will see during the car buying process.

What Does The MSRP Include?

The MSRP includes the base price for the new car, extra factory options or packages, dealer add-ons (if applicable), and the destination charge (which can vary by state). It does not include rebates, tax, title, license, or any other fees.

Can You Buy a New Car for Less Than MSRP?

Although they vary by vehicle, region, and time of year, manufacturer rebates (sometimes called factory incentives) are available when buying a new car. You may even qualify for additional rebates, like military service or if you are a college student. You can check the current rebates and incentives on an automaker’s website. Every rebate you are eligible for is subtracted from the MSRP.

There is a tendency to “negotiate down” from MSRP, but it might be better to negotiate up from the invoice price.

What Is The Invoice Price?

Generally speaking, the invoice price is what the dealer pays for the new cars on its lot. When a manufacturer ships a vehicle from the factory, the dealership is handed a bill (or an invoice). Invoice prices are lower than the MSRP but not as easy to find.

The invoice price can be tricky because it’s not readily accessible. One common question is how much lower is the invoice price actually than the starting MSRP. Or is the invoice price really a good deal after all? The answers can and do vary, as every new vehicle is priced differently.

Your goal before visiting a dealership is to get as much information as possible about the amount you will pay for a new car. For now, let’s focus on the invoice price and what it means in the consumer world, not the dealership world. For you, the invoice price generally represents the lowest possible number as a starting point for negotiations.

Why Is Invoice Pricing Important?

In the typical car sales environment, the odds are stacked against you. Dealers sell vehicles every day, whereas you may only buy one every few years. They have their sales process down, they know how to negotiate, and they know how much money is on the table with every vehicle on their lot. That said, it’s crucial to have the ball in your court when you negotiate.

The common strategy is to negotiate down from the MSRP. But remember where MSRP falls at the “higher and easy” end of the spectrum. If you start here, you are at a disadvantage. How the typical dealership pays its sales consultants is part of the reason why.

If they are paid on the gross amount of each vehicle they sell, there is an incentive to keep you at the higher end of the pricing scale or closer to the MSRP. The closer to the MSRP they sell the vehicle, the higher the dealer’s profit margin and the bigger the commission check. And this starts the “unspoken battle” that causes stress for buyers. The dealer is trying to get you to pay more for the vehicle, and you are trying to pay less!

Invoice prices are important because knowing what they are will allow you to negotiate up rather than down. Rather than starting high at the MSRP, which is of more benefit to the dealership, you are beginning at a lower point with the invoice price (or closer to what the dealer paid for the vehicle), which is better for you.

How Do You Find Invoice Pricing?

One way is to simply ask for the invoice price of the new car you are looking at. If you are nervous about this, try phrasing it like this:

“I understand that invoice pricing might be available. May I ask what that is on this particular vehicle? I have read good things about this manufacturer (or make/model) and about your dealership online. I would be interested in possibly making a deal, but I want to ask for the invoice pricing first.”

With this approach, you are turning the sales game back onto the dealership. You are subtly suggesting that by providing the invoice price (the amount that is the lowest starting point for negotiation and the hardest to come by), they will live up to their good name. When you negotiate, it never hurts to have a few lines like this in your back pocket.

Here is another one you can try:

“I am looking at a few different vehicles at different dealers right now. Based on my research online, I understand that a dealer invoice price might be available? If so, may I see it with regard to this particular car? If not, that’s okay, but I want to get an idea of what the costs are and what I may have to pay after all the factory rebates, dealer incentives, and fees are applied.”

This line implies that while seeing the dealer invoice is important, it’s also not the end of the world. Suppose the invoice price is, for whatever reason, not available through this particular dealership. In that case, it still communicates that you are shopping around and will only consider a fair “out-the-door” price.

While shopping for a new vehicle, it’s best to focus on the final price instead of monthly payments. If you consider the buying process as a whole entity, it will lessen the chances of you falling victim to a common dealer tactic of showing you “way over book value” for your trade while simultaneously inflating the price of the vehicle you are considering.

MSRP vs. Invoice Price: Quick Recap & Tips

- New car prices ebb and flow with the calendar year.

- Seek out all manufacturer rebates and dealer incentives.

- Make sure to ask the dealer about any other additional fees.

- Ask the dealer politely if they can show you the invoice price.

What Does F&I Mean?

This is an acronym for Finance and Insurance, but it’s less of a term and more of a separate process. Internally, this is sometimes known as the “hand-off” phase of the deal. It means the sales consultant has sold the car; now it’s time for another staff member to take over.

Those staff members are F&I managers, and they are responsible for this part of the transaction. If you are financing, F&I managers handle the credit apps and help you sign all the paperwork at the end.

Going Through The F&I Process

F&I managers will likely present you with optional “add-ons.” This can include window tint, rear entertainment systems, fabric protection, window etching, and other accessories, like a tonneau cover if you are purchasing a truck.

Truck accessories are one thing, as there is usually an element of styling and functionality, but otherwise, very few add-ons presented at the dealership are essential (you can avoid things like “rust proofing” the undercarriage, for example).

If you opt for additional accessories or add-ons, consider paying for them in cash. During the F&I process, there is a natural assumption that everything will go into the loan unless you say otherwise. If you want a few extra accessories for your new vehicle, there is nothing wrong with that, but don’t pay for them over the next 60 months with interest.

Extended Warranties: Yes or No?

The most common item during the F&I process is an offer for an extended warranty, sometimes called an extended service contract. Schools of thought vary on extended warranties, so take everything with a grain of salt and consider your personal situation and preferences more than anything.

While not a hard and fast rule, an extended warranty might benefit you if you drive a ton of miles or plan to keep the vehicle for longer than five years. If not, you are probably okay with the standard factory warranty. A good F&I manager will get a sense of how much you plan to drive the new vehicle and present options accordingly.

If you are interested in an extended warranty, you don’t have to purchase one through the dealership. After conducting thorough market research and competitive comparisons, our team picked the provider above, along with a handful of others, as the best extended car warranty companies today.

While shopping for an extended warranty, ask for sample contracts and look for the area where the claims process is explained. Avoid contracts that are not transferable or cannot be canceled easily. To help get the most out of any extended warranty, see these insider tips from a repair shop owner.

Auto Loan Rate Comparision Tool

It’s a good idea to secure your own financing before visiting the dealership. The calculator below will help get you started.